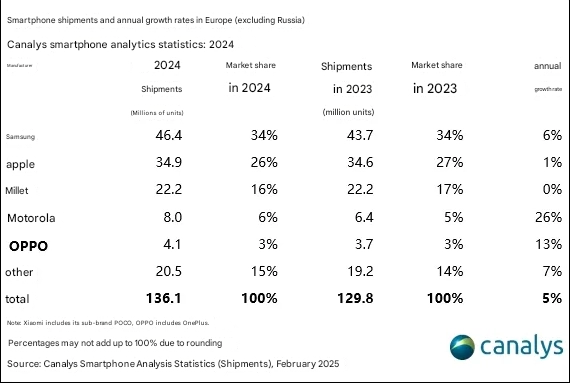

After four consecutive years of decline, Europe’s (outside of Russia) smartphone market is on the rise, growing 5% year-over-year in 2024, according to Canalys in their recent report. The rise is evidence of reawakened consumer desire and market share triumphs for leading smartphone makers in Europe.

Market leaders: Apple, Samsung, and Xiaomi

Samsung solidified its leadership in Europe’s smartphone market by reporting 6% year-over-year sales growth to 46.4 million in 2024. The sales surge was powered by Galaxy S24 models’ popularity and robust sales in the mid-range market.

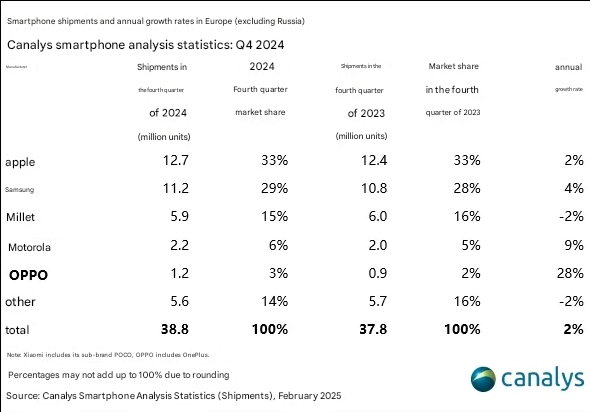

Apple also did well, becoming Q4 2024’s leading smartphone maker, driven by market acceptance for last year’s 16 series of iPhones and regular sales for last year’s models including 13 and 14. Apple’s year-over-year total shipping rose 1%, to 34.9 million.

Xiaomi retained Europe’s third rank in 22.2 million phone shipments, maintaining 2023 shipping volumes. The brand stayed strong in performing through Redmi and POCO sub-brands, capturing price-conscious customers and expanding through competitively priced middle-end options.

Strong Expansion for OPPO and Motorola

Motorola emerged as one of 2024’s top performers, posting an impressive 26% rise in shipments, passing 8 million. The focus on the middle and low-end ranges by the brand helped, as EU customers sought credible options apart from the top three.

Meanwhile, OPPO (including OnePlus) secured the fifth position in the European smartphone market, with a 13% increase in shipments, reaching 4.1 million units. The company benefited from strategic partnerships and the growing appeal of its premium devices.

Premium Phone Market Reaches Historic High

According to Canalys’ Runar Bjørhovde, premium phone sales in the range of $800 and up recorded record-breaking volumes in 2024, passing 41 million. Apple and Samsung powered this sector, driven by greater desire to invest in premium phones and futureproofed capabilities.

Outlook for 2025

As the pace of the European market for smart phones accelerates, competition amongst leading brands is expected to intensify. The market is poised to be driven by drivers including continued premium smart phone desire, expanding AI-enabled capabilities, and enhanced mid-range smart phone options in the upcoming year.

Canalys’ latest reports identify Europe’s smartphone market hitting a tipping point, where leading vendors capitalize on shifts in consumer behavior and innovations to sustain growth in a recovery market.

HyperOS Downloader

Easily check if your phone is eligible for HyperOS 2.0 update!